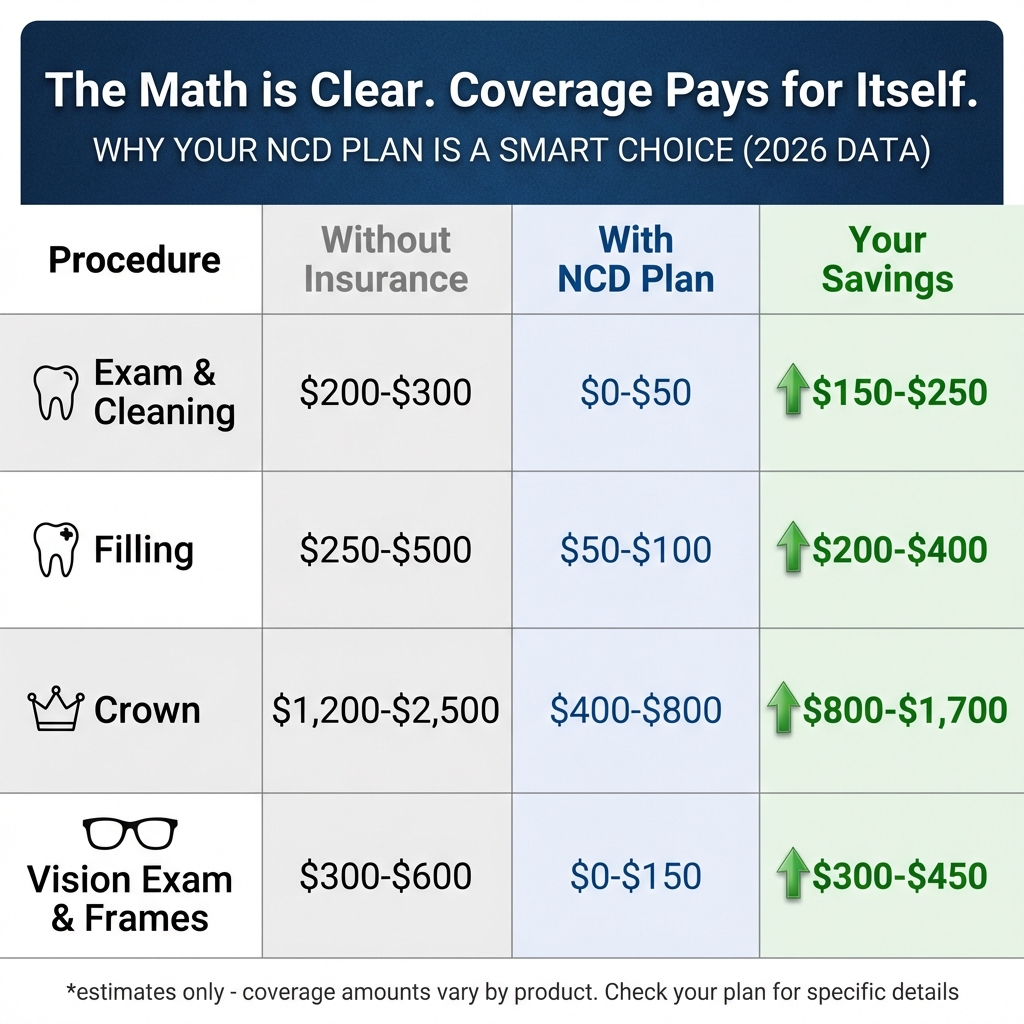

Dental insurance savings add up fast—coverage often pays for itself with just one procedure. #DentalInsuranceSavings The real question isn’t whether you can afford coverage, it’s whether you can afford not to have it. When you compare the actual costs of dental care with and without insurance, the math becomes undeniably clear.

⠀

In this comprehensive breakdown, we’ll show you exactly what dental and vision procedures cost in 2026, what you’ll pay with quality coverage like NCD dental and VSP vision plans, and the real savings you can expect throughout the year.

⠀

The True Cost of Dental Care in 2026

⠀

Dental costs have increased significantly over the past decade, yet many people underestimate what they’ll pay when they actually need care. Understanding current pricing helps you evaluate whether insurance makes financial sense for your situation.

⠀

Preventive Care Costs

⠀

**Routine exam and cleaning (without insurance):** $150 – $350

⠀

This range depends on your location, the specific dental practice, and whether additional services like X-rays are included. Urban areas and specialty practices typically charge toward the higher end.

⠀

**With NCD dental coverage:** $0 (100% covered after deductible is met)

⠀

All NCD dental plans cover preventive care—including exams, cleanings, and routine X-rays—at 100% once your lifetime deductible is satisfied. On plans like NCD Complete and Elite 5000, you get three cleanings per year at no additional cost.

⠀

**Your savings:** $150 – $350 per cleaning, or $300 – $700+ annually if you get the recommended two cleanings per year.

⠀

Basic Restorative Care Costs

⠀

**Composite (tooth-colored) filling (without insurance):** $250 – $450 per filling

⠀

Composite fillings have become the standard for most visible teeth. The cost depends on the size of the filling and the tooth location.

⠀

**With NCD dental coverage:** $50 – $90 per filling (80% covered)

⠀

Basic restorative procedures like fillings are typically covered at 80% on quality dental plans. Your out-of-pocket cost is just the remaining 20%.

⠀

**Your savings:** $200 – $360 per filling

⠀

Consider that the average adult gets 1-2 fillings over any given two-year period. Even occasional basic work generates significant savings.

⠀

Major Restorative Care Costs

⠀

**Porcelain crown (without insurance):** $1,200 – $2,500 per crown

⠀

Crowns are among the most common major dental procedures. When a tooth has significant decay, fracture, or previous large fillings, a crown provides structural protection.

⠀

**With NCD dental coverage:** $600 – $1,250 per crown (50% covered, increasing after year one on some plans)

⠀

Major procedures are typically covered at 50%, though this percentage often increases in subsequent years of continuous coverage.

⠀

**Your savings:** $600 – $1,250 per crown

⠀

A single crown can save you more than an entire year’s premium on most dental plans.

⠀

**Root canal plus crown (without insurance):** $2,500 – $4,000

⠀

When a tooth becomes infected, root canal therapy followed by a protective crown is the standard treatment to save the tooth.

⠀

**With NCD coverage:** $1,250 – $2,000

⠀

**Your savings:** $1,250 – $2,000

⠀

Implant Costs

⠀

**Single dental implant (without insurance):** $3,000 – $6,000

⠀

Implants are the gold standard for replacing missing teeth, but the cost puts them out of reach for many people paying out of pocket.

⠀

**With NCD Complete dental coverage:** $1,500 – $3,000 (using the dedicated $3,000 annual implant benefit)

⠀

NCD Complete includes a separate $3,000 implant allowance that doesn’t count against your regular annual maximum.

⠀

**Your savings:** $1,500 – $3,000 per implant

⠀

For anyone considering implants, this single benefit can justify years of premium payments.

⠀

The True Cost of Vision Care in 2026

⠀

Vision care costs often catch people off guard—especially those who haven’t purchased glasses or contacts in several years.

⠀

Eye Exam Costs

⠀

**Comprehensive eye exam (without insurance):** $150 – $300

⠀

A thorough WellVision exam includes refraction testing (your prescription), eye health evaluation, and screening for conditions like glaucoma and macular degeneration.

⠀

**With VSP Preferred vision coverage:** $20 copay

⠀

Your exam is covered after a simple $20 copay. The exam includes not just prescription determination but comprehensive eye health screening.

⠀

**Your savings:** $130 – $280 per exam

⠀

Prescription Eyewear Costs

⠀

**Basic prescription glasses with quality frames (without insurance):** $200 – $400

⠀

This assumes a simple single-vision prescription in moderately priced frames. Designer frames or complex prescriptions cost more.

⠀

**Progressive lenses in quality frames (without insurance):** $400 – $700

⠀

If you’re over 40 and need progressive lenses (no-line bifocals), costs increase substantially. Quality progressive lenses alone can cost $300-$500.

⠀

**With VSP Preferred vision coverage:**

– Frame allowance: $200 ($220 on featured brands)

– Single vision lenses: $25 materials copay

– Progressive lenses: $25 materials copay + $50 progressive copay

⠀

**Your out-of-pocket for glasses with VSP:** $45 – $100 (depending on frame selection and lens type)

⠀

**Your savings:** $155 – $600+ per pair

⠀

Contact Lens Costs

⠀

**Annual contact lens supply (without insurance):** $300 – $600

⠀

Daily disposable lenses and specialty lenses (for astigmatism or multifocal needs) cost toward the higher end.

⠀

**Contact lens fitting exam (without insurance):** $50 – $100 additional

⠀

Contacts require a separate fitting exam beyond the standard vision exam.

⠀

**With VSP Preferred:** $150 annual contact lens allowance (includes fitting exam)

⠀

**Your savings:** $200 – $550 annually for contact lens wearers

⠀

The Complete Annual Savings Picture

⠀

Let’s calculate realistic annual savings for different scenarios:

⠀

Scenario 1: Individual with Basic Dental and Vision Needs

⠀

**Annual costs without insurance:**

– Two dental cleanings/exams: $400

– One filling: $350

– One eye exam: $200

– One pair of glasses: $300

– **Total: $1,250**

⠀

**Annual costs with NCD Elite 5000 + VSP Preferred:**

– Premium: $660 (dental) + $264 (vision) = $924

– Dental copays: $0 (preventive) + $70 (filling) = $70

– Vision copays: $20 (exam) + $50 (glasses) = $70

– **Total: $1,064**

⠀

**Annual savings: $186** plus peace of mind for unexpected major work

⠀

Scenario 2: Individual Needing Major Dental Work

⠀

**Annual costs without insurance:**

– Two cleanings/exams: $400

– One crown: $1,800

– One eye exam: $200

– One pair of progressives: $550

– **Total: $2,950**

⠀

**Annual costs with NCD Elite 5000 + VSP Preferred:**

– Premium: $924

– Dental: $0 (preventive) + $900 (crown at 50%) = $900

– Vision: $20 (exam) + $75 (progressives) = $95

– **Total: $1,919**

⠀

**Annual savings: $1,031**

⠀

Scenario 3: Family of Four with Typical Needs

⠀

**Annual costs without insurance:**

– Eight cleanings/exams: $1,600

– Three fillings (kids): $900

– Four eye exams: $600

– Two pairs of kids’ glasses: $500

– One pair of adult progressives: $550

– **Total: $4,150**

⠀

**Annual costs with NCD family plan + VSP Preferred Family:**

– Premium: Approximately $1,800/year combined

– Dental copays: $0 (preventive) + $180 (fillings) = $180

– Vision copays: $80 (exams) + $150 (glasses) = $230

– **Total: $2,210**

⠀

**Annual savings: $1,940**

⠀

Beyond Direct Savings: Hidden Value of Coverage

⠀

The numbers above capture direct cost comparisons, but insurance provides additional value that’s harder to quantify:

⠀

Preventive Care Compliance

⠀

When cleanings are covered at 100%, people actually get them. Studies consistently show that insured individuals receive more preventive care than the uninsured. This prevention reduces the likelihood of needing expensive restorative work later.

⠀

The cost of preventing a cavity through regular cleanings and fluoride treatments is far less than the cost of treating that cavity after it develops—and exponentially less than treating the root canal and crown needed if the cavity is ignored too long.

⠀

Earlier Problem Detection

⠀

Regular dental exams catch small problems before they become large, expensive problems. A small cavity detected early requires a simple filling. That same cavity discovered a year later might require a crown or root canal.

⠀

Similarly, regular vision exams can detect serious health conditions—diabetes, high blood pressure, even certain cancers—in their early stages when treatment is most effective.

⠀

Access to Quality Care

⠀

Insurance networks include vetted, credentialed providers. MetLife’s dental network and VSP’s vision network include practitioners who meet professional standards and agree to negotiated fee schedules.

⠀

This provides both quality assurance and cost protection—even out-of-network services often receive partial coverage, preventing the sticker shock of retail pricing.

⠀

Financial Predictability

⠀

Perhaps the most undervalued benefit of insurance is predictability. Instead of facing unknown, potentially large expenses when dental or vision problems arise, you have predictable monthly premiums and defined copays.

⠀

This predictability makes budgeting easier and eliminates the financial anxiety that causes many people to delay necessary care.

⠀

When Does Insurance NOT Make Sense?

⠀

Transparency matters. There are situations where dental and vision insurance might not be the best financial choice:

⠀

**Excellent dental health with no history of problems:** If you’ve never had a cavity, have no gum disease risk factors, and your family history suggests continued good dental health, the math on dental insurance is closer. However, you’re also gambling that this luck continues indefinitely.

⠀

**No vision correction needs and excellent eye health:** If you don’t wear glasses or contacts and have no family history of eye disease, basic vision insurance provides less obvious value. However, the health screening benefits of annual eye exams still provide protection.

⠀

**Access to better employer coverage:** If your employer offers comprehensive dental and vision coverage at subsidized rates, that’s usually the better financial choice. Evaluate your employer plan carefully before purchasing individual coverage.

⠀

**Very limited budget with no current dental needs:** If money is extremely tight and you have no pending dental work, delaying coverage while addressing more immediate financial concerns might be reasonable—with the understanding that you’re accepting risk.

⠀

For most people in most situations, however, the math favors coverage. Even those with excellent dental history benefit from the catastrophic protection insurance provides against unexpected major expenses.

⠀

Making the Investment Work Harder

⠀

If you decide coverage makes sense, here’s how to maximize your return:

⠀

**Use all your preventive benefits:** Three cleanings per year on NCD Complete cost you nothing and provide substantial value. Don’t leave benefits on the table.

⠀

**Time major work strategically:** If you need multiple crowns, spreading them across calendar years maximizes your annual maximum utilization.

⠀

**Understand your network:** In-network providers have agreed to fee schedules that reduce your costs. Check network status before scheduling.

⠀

**Combine dental and vision:** Bundling coverage often provides better overall value than purchasing separately.

⠀

**Consider coverage level carefully:** Higher premium plans like NCD Complete have higher annual maximums. If you anticipate major work, the premium difference is often recovered in better coverage.

⠀

Getting Started with Coverage and securing your Dental Insurance Savings

⠀

The numbers tell a clear story: for most people, quality dental and vision insurance saves money while providing protection against unexpected major expenses.

⠀

NCD dental plans through MetLife offer annual maximums from $750 to $10,000, immediate coverage with no waiting periods, and access to one of the nation’s largest dental networks. VSP Preferred vision coverage provides comprehensive benefits starting at just $22 per month for individuals.

⠀

We help individuals and families find the right coverage combination for their specific situations. Whether you’re looking for maximum protection, balanced coverage, or budget-friendly options, we can help you understand what each plan provides and which makes sense for your needs.

⠀

**→ Get Your Coverage Quote:**

⠀

**→ Learn More About Plan Options:**

⠀

Questions about coverage or costs? Text us at (949) 506-2746 or email info@curlinsuranceservices.com. We’ll help you run the numbers for your specific situation.